Civil Litigation

Investment

"Licensed professionals are rarely businessmen."

P. Daniel Villagómez

Villagómez Capital offers investment opportunities in a unique alternative asset, civil litigation, that can enhance your portfolio with Alpha (α), achieving a performance of up to 24% IRR.

Civil Litigation Investment is made up of three components:

Law Firm Financing

Plaintiff Funding

Medical Factoring

Billionaire George Soros, legendary hedge fund tycoon who Founded Soros Fund Management, along with private equity behemoth Apollo Global Management founded by billionaires Leon Black, Joshua Harris and Marc Rowan ($631 billion in assets in 2023) are among the first money managers to jump in to this niche of the lawsuit-funding market.- Bloomberg

These special purpose vehicle funds, have attracted investors like Peter Thiel (co-founder of PayPal and Palantir Technologies, and early investor In Facebook, LinkedIn, Yelp, SpaceX, Airbnb, etc.) and Counsel Financial, a Buffalo company financed by financial giant Citigroup. – New York Times The New Yorker

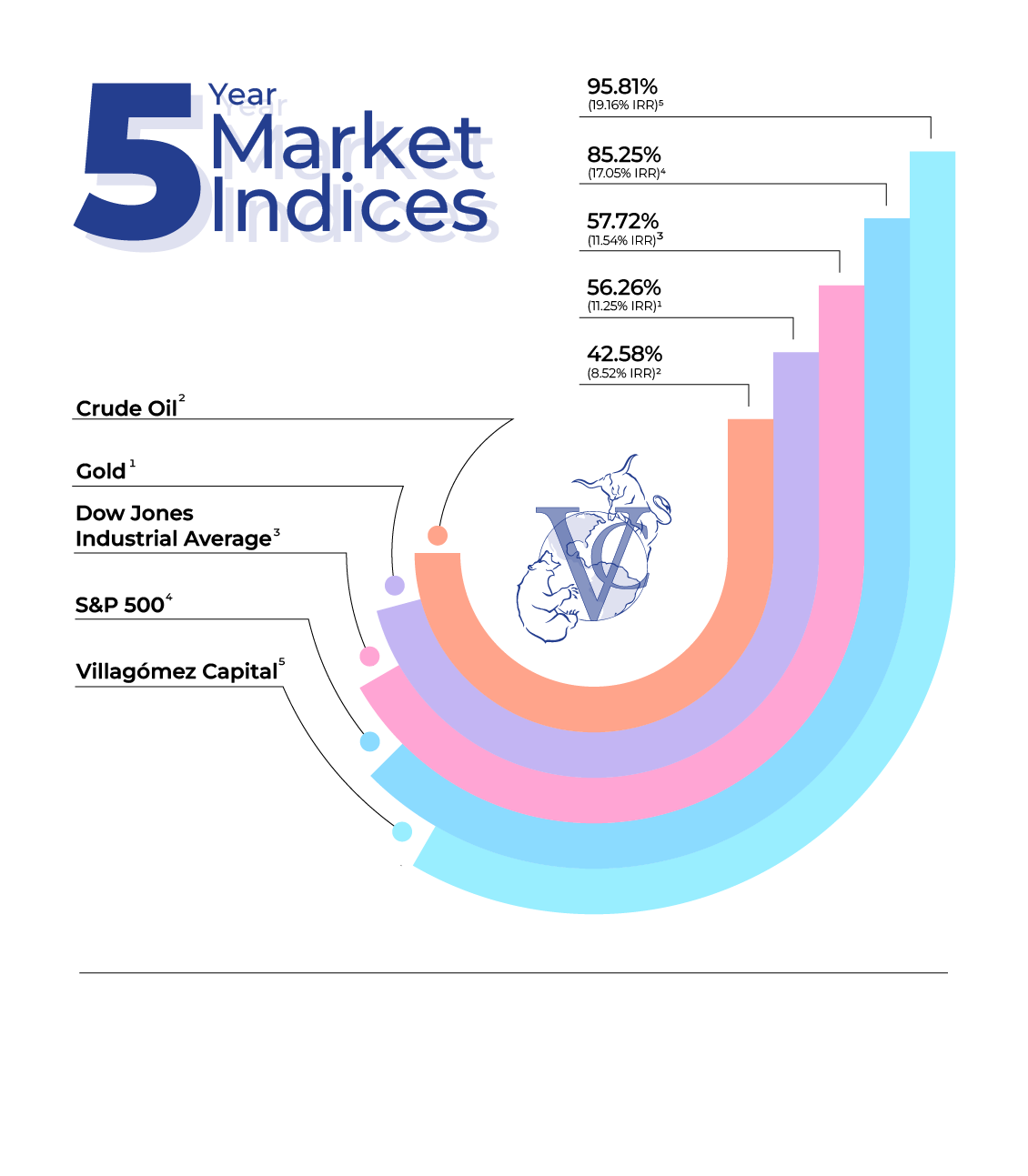

Alpha (α) in simple terms is an investment strategy’s ability to beat a benchmark. Our niche alternative assets have consistently outperformed the Dow Jones Industrial Average, S&P 500, Gold and Crude Oil over five years.

¹ COMEX Delayed Price from January 14, 2019 open of $1,289.10 to January 11, 2024 close at $2,014.30.

² NY Mercantie Delayed Price from January 14, 2019 open of $50.51 to January 11, 2024 close at $72.02.

³ DJI Real Time Price from January 14, 2019 open of $23,909.84 to January 11, 2024 close at $37,711.02.

⁴ SNP Real Time Price from January 14, 2019 open of $2,580.31 to January 11, 2024 close at $4,780.24.

⁵ Villagómez Capital from January 14, 2019 to January 11, 2024

Villagomez Capital will serve as the credit facility for smaller funding companies and brokers. We are nearing completion of a proprietary Customer Relationship Management (CRM) software dedicated to this industry. Our CRM is the only software that considers legal status of the case, medical modalities, national and local data, emotional, cognitive, and human bias, among other data points, to best underwrite any funding needs.

Villagomez Capital will purchase, finance, and manage portfolios for smaller funding companies that do not have access to capital or have a financial relationship with larger competitors unwilling to share profits. Volume has always proven to be a more profitable model. We will offer commissions and/or profit-sharing to exponentially increase our market share.